How much mortgage can i borrow with 50k salary

Borrow as little as possible repay as quickly as possible. On a 60k salary or a 40k salary.

How Much Would Be My Take Home Pay With 7 50 000 Inr Per Annum Quora

And beware while borrowing over a longer period spreads the debt and decreases monthly.

. I quit my job and make 0 dollars but can magically survive. You can use our loan calculator to compare a range of 50000 loans from popular lenders based on monthly payment size and APR. What is my hourly rate if my annual salary is.

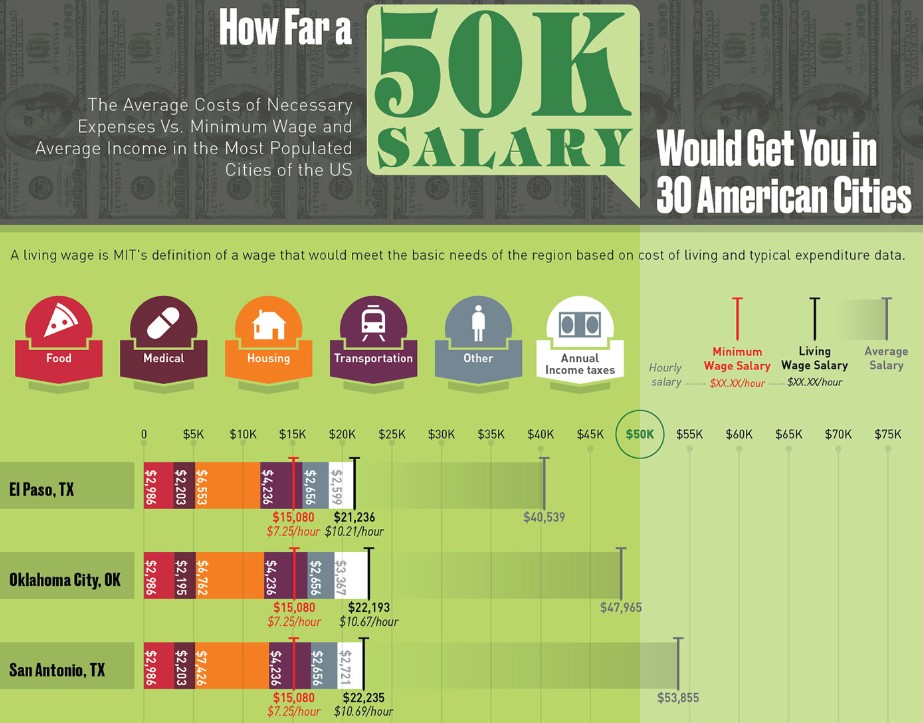

Typical lending limits are around 5x your annual pre-tax salary so if you earn 50k the maximum mortgage you could get would be 250k. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. I will be jobless for 18 months before my state pension and I owe.

To calculate your hourly rate from your annual salary please refer to the chart below. Most mortgage lenders will consider lending 4 or 45 times a borrowers income. I think that for most situations a good starting point is 25 times your income.

You could be owed 80000 in unclaimed state pension payouts. With a personal loan you can borrow between 2000 and 50000 across 6 months to 7 years. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

To avoid complications always base your borrowing on what you can comfortably afford to repay preferably after doing a budget as borrowing too much can cause debts to spiral out of control. Stay at home mum in the 80s or 90s. How to use our 50000 repayment calculator.

The minimum salary is 40k-50k whereas for more typical borrowing 20-25k is standard. However there are some lenders that offer up to 100000 for individual or joint applicants. Make sure you speak to an expert about this as just going to your current lender limits your options and if youre declined it can harm your overall chances of securing the outcome you want.

It will depend on your Salary Affordability Credit score. A property I inherited was overvalued by 50k - can I get any inheritance tax back and do I face a double whammy on CGT. Simply enter how much you want to borrow how long you want the loan for the value of your property and mortgage then well find you the loan that could best suit your situation.

Growing your wealth is easy. Borrowers who dont have much debt to consolidate may struggle to find a suitable loan with other lenders. With our quick digital pre-approval you can instantly discover how much you can borrow.

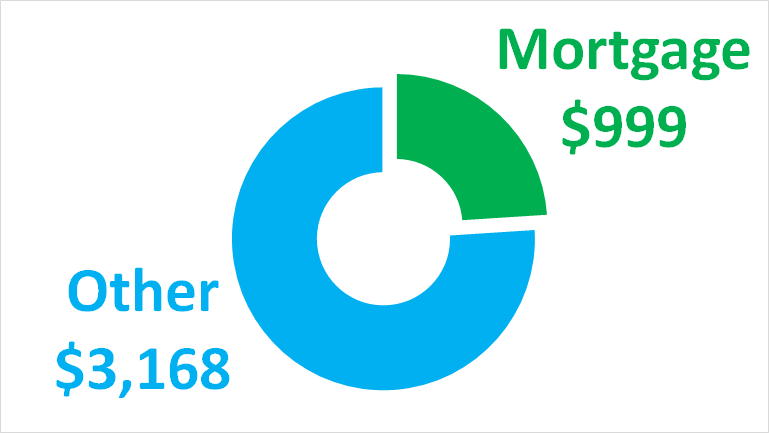

While you can pick and choose the borrowers you lend to personally there arent as many guarantees in place for P2P lending as there are in more traditionally-structured investments or lending. Heres how you can buy a house with a 50K salary. Total monthly mortgage payments are typically made up of four components.

Principal interest taxes and. 50K to 59k per year. However loans typically range.

Bank of England scraps mortgage affordability stress test - but experts say it will do little to help people buy their first home or borrow more Test required lenders to factor in a 3. The minimum amount you can invest in a P2P loan will depend on the business facilitating the loan. It assumes 40 hours worked per week and 20 unpaid days off per year for vacation and holidays.

Latest from Pensions. Find out more in our Guide. Rental price 70 per night.

How Much House You Can Afford. 10 years from now housing market in NYC appericiates 10. Save 12 of salary towards a pension New plan calls for a.

How much interest will pay to borrow each month. Save 12 of salary. How much money you can borrow will depend on the lenders you choose what kind of bad credit loan you choose and if the lender considers other factors beyond credit.

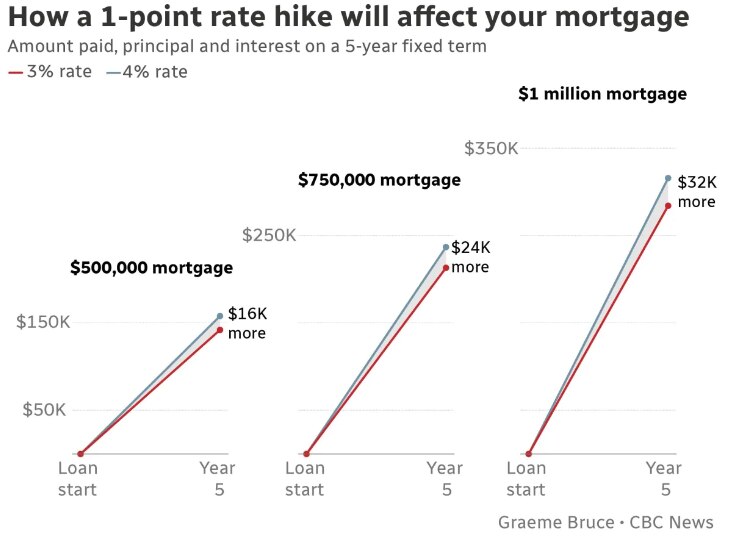

In real terms The Office of Budget Responsibility has predicted mortgage interest costs to rise in 2022 and then increase by an average of 131 per cent in 2023. On a 60k salary or a 40k salary. For example I buy a 500k house in NYC now.

How much mortgage can you borrow on your salary. The table below shows example calculations for maximum borrowing based on salaries between 50000 and 59000 per year. Future mortgage shock looms for fixed rate borrowers Interest rates will rise to more than 4 next year and remain.

Ive seen banks recommend ratios as low as 15 times your salary or as high as five times your salary. I will be jobless for 18 months before my. Wondering what hourly rate you earn on a 50k annual salary in Ontario.

Five-year fixed rates are by far the most popular. Salary transfer of AED 50K Average balance of AED 500K Home loan of AED 25M min Insurance plan with annual premium of AED 300K. It assumes 40 hours worked per week and 20 unpaid days off per year for vacation and holidays.

Majority back state pension triple lock increase to 10k-plus a year - but. Since the base rate began rising in December 2021 the two-year rate has increased by 091 per cent and the five-year rate by 073 per cent. However there are some lenders that offer up to 100000 for individual or joint applicants.

Discover a selection of Home Finance options with our mortgage experts. A property I inherited was overvalued by 50k - can I get any inheritance tax back and do I face a double whammy on CGT. Find out How Much You Can Borrow for a Mortgage using our Calculator.

Impact on debt consolidation borrowers. Isnt it hard to buy another house if you are paying your 1st mortgage and then have to make enough for your 2nd mortgage. To calculate your hourly rate from your annual salary please refer to the chart below.

PenFeds 600 minimum ensures that you dont have. The general rule is that you can afford a mortgage that is 2x to 25x your gross income.

Bank Of Canada Hikes Rate To 2 5 Here S What It Means For You Radio Canada Ca

All The Ways To Save On Your Mortgage True North Mortgage

How Much House Can I Afford 50k Hotsell Save 31 Umitochi Com Au

Can I Buy A House With My Salary Step By Step Affordability Guide Tightfist Finance

How Much House Can I Afford 50k Hotsell Save 31 Umitochi Com Au

Does Anyone Actually Qualify For A 50k Loan Loans Canada

Interest Rates Are Rising And 58 Of Canadian Heloc Holders Have An Outstanding Balance Ratesdotca

How Much Car Can I Afford On 50k Salary Tightfist Finance

I Make 50 000 A Year How Much House Can I Afford Bundle

Does Anyone Actually Qualify For A 50k Loan Loans Canada

Are You Choosy About How We Price Carbon Income Tax Tax Protest Tax Day

How Much Should I Invest For 15 Years To Get A Monthly Income Of Rs 50 000 After Retirement Quora

Does Anyone Actually Qualify For A 50k Loan Loans Canada

How Much Car Can I Afford On 50k Salary Tightfist Finance

How Much House Can I Afford 50k Hotsell Save 31 Umitochi Com Au

Money Makeover Can I Buy A London Home On A 50k Salary

The Salary You Need To Buy A Home In Cities Across Canada R Personalfinancecanada